Why Don’t More Kenyans Insure Their Dream Homes?

Property and Domestic Insurance Have Lowest Uptake

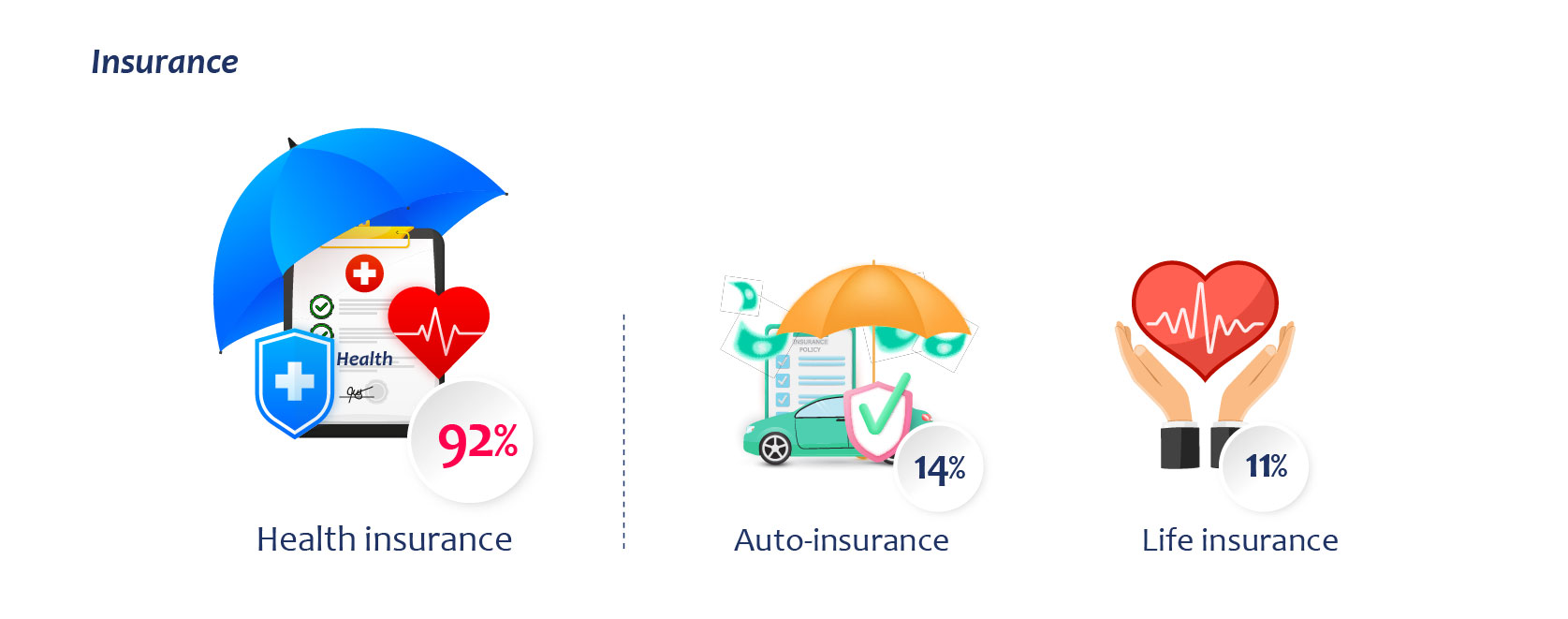

Owning a house is a leading Kenyan aspiration. But insuring those dreams is where they stop. As found by the latest Wakenya study, Health is the top insurance cover at 92pc – thanks to NHIF – followed by (mandatory) auto-insurance at 14pc. Life insurance exists at 11pc, but trended downwards before a recovery in 2023, similar to education policies. Meanwhile, property and domestic insurance is negligible. Are underwriters ready for this conversation?

Subscribe to our snippets