|

Voices is a free Consumer Insight newsletter with relevant market insights. |

|

|

|

|

|

Are Traditional Family Values Dying Out?

|

|

|

It can seem that hardly a day goes past without gloomy media speculation that traditional family values are breaking down. But are such interpretations exaggerated? Using the latest research from TGI, we investigate whether strong family ties still exist and how they vary across the world. |

|

|

|

Living Alone

The rise in single person households in some countries has been held up as the ultimate symbol of family breakdown. Yet, as the lates Taiwan, Hong Kong, and Indonesia, living alone is highly unusual, with only around 5% of people doing so. A similar situation exists in Latin America. Even in the West, it’s still fairly uncommon; Germany and Sweden have the highest proportion of single dwellers (around one in five people) but in Spain and the USA they account for only 8 and 14% of the population (respectively).

|

|

|

Traditional Ties

Rising divorce rates and the increasing prevalence of single parent families might indicate disillusionment with the concept of long term commitment. Yet TGI research shows that really we’re still pretty traditional; in most of the countries studied, two thirds or more of the adult population are either married or co-habiting with a partner. Most people also agree that it’s important to have a lasting relationship with one partner, including over 70% of people in Kenya, Uganda and Tanzania.

|

|

|

|

|

|

Spending time with the family TGI research shows that families across the world continue to value their time together. Nearly 80% of Kenyans, Ugandans and Tanzanians say they enjoy spending time with their families and 84% of Indians say this is their favourite pastime. Encouragingly, only 16% of Brits say they rarely sit down for a meal together at home (and there is a similar situation in the rest of Western Europe) although nearly 40% of Russians admit this is the case in their households. |

|

|

|

|

|

|

|

|

|

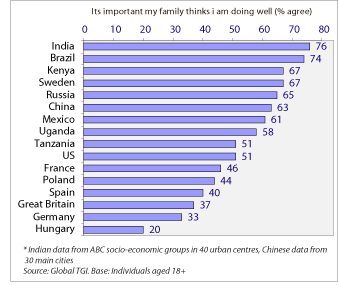

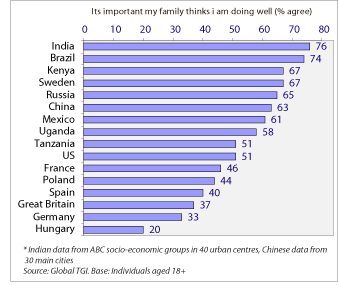

Family Expectations

However, it seems that although we love our families, we can feel pressurised by their expectations (a theme particularly evident in parts of Asia and Latin America). In China, there is often a sense of responsibility to succeed for ones family, and to provide economic support for parents in their old age. So although the emerging middle class in China are enjoying the benefits of their new found material wealth, their traditional sense of obligation remains - 63% feel it’s important their family think they are doing well. In East Africa, over half of parents want their children to get ahead of others, even if it means putting a lot of pressure on them. Europeans, on the whole, seem to care rather less about this; only 20% of Hungarians and a third of Germans are fussed whether their family regard them as successful. |

|

|

|

|

|

|

A Universal Value

From the research, the importance of the family emerges as a ‘universal’ value; that is, a view held to a similar extent in every market. Global brand owners entering local markets can thus safely incorporate these values into their campaigns. |

|

About TGI

The Global TGI network operates single-source consumer and media studies in over 50 countries worldwide. Used by brand owners, media owners and agencies, it measures consumers' product and brand usage, media consumption and attitudes, based on large samples - over 700,000 respondents annually worldwide. A typical survey will cover around 4,000 brands and 500 product categories.

TGI was originally developed in the UK by BMRB, one of the UK's leading marketing research companies. BMRB is part of the KMR Group, which markets TGI globally.

In East Africa Consumer Insight have the sole rights to conduct TGI in this region. The first survey was conducted in 2005 in the 3 countries and since then Consumer insight has continued to conduct the study in East Africa. This is one of the largest surveys in this region with a sample size of 18,000 across 30 towns in this region.

Contact

Githinji Njogu – Branded Research Manager : 020-535809/536765

gnjogu@ciafrica.com, tgi@ciafrica.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|